The new security device for CIMB Clicks Internet Banking enables you to generate a One-Time-Password (OTP) for your online transactions.

In addition, it offers a new security feature – Transaction signing. This feature provides you enhanced protection for your online transactions by generating an OTP that is unique to the transaction information.

Customers who use SMS-OTP or OTP-Token

You can continue to use your existing SMS-OTP or OTP-Token to access Clicks Internet Banking and perform all transactions. With effect from 1 January 2013, you will require the security device for the transactions below.

Transaction that requires the Security Device:

- Add new Funds Transfer beneficiaries as “Favourite” accounts

- Add new Bill Payment payees as “Favourite” accounts

- Perform Funds Transfer or Bill Payments to “Non-Favourite” accounts

- Perform Telegraphic Transfer

- Change Clicks Internet Banking Daily Limits

- Change Email Address or Mobile Number to receive Transaction Alerts

You will be provided with on-screen instructions to guide you on using the Security Device when you perform transactions 1 – 6.

Activation of CIMB Clicks Internet Banking Security Device:

- Login to CIMB Clicks Internet Banking via www.cimbclicks.com.sg using your existing SMS-OTP or OTP-Token.

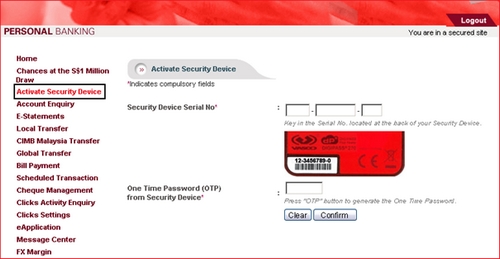

- Click on “Activate Security Device” on the left navigation panel.

- Follow the on screen instructions to activate your Security Device.

Note: If you are a new CIMB Clicks Internet Banking customer, please call CIMB At-Your-Service (65) 6333 7777 (Mondays to Sundays, between 9.00 am to 9.00 pm) to activate your Security Device.

Learn more about our new security device.

|